Uniswap is a fully decentralized cryptocurrency exchange platform, launched in 2018 by Hayden Adams on the Ethereum blockchain. It is part of the key projects of decentralized finance (DeFi), a fast-growing sector that seeks to make finance accessible to all, without going through intermediaries like banks or financial institutions.

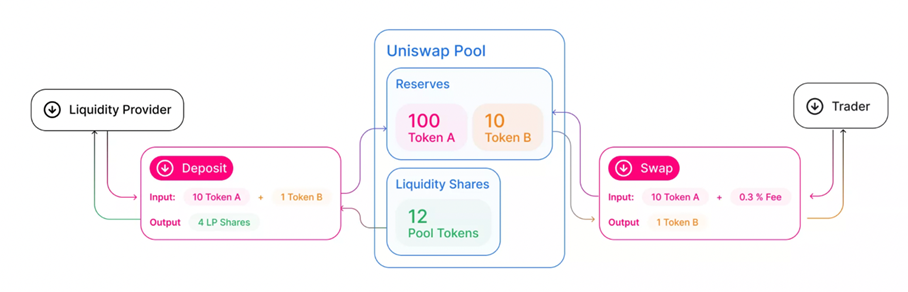

From the start, Uniswap was designed to allow any user to easily exchange tokens without needing an account, a trusted third party, or centralized control. The protocol offers an innovative technology called Automated Market Maker (AMM), which replaces the traditional order book system with liquidity pools. Uniswap aims to create an open, fair and globally accessible system, in which everyone can participate in exchanges, provide liquidity or interact with decentralized applications.

Source : wikipedia

How Uniswap has evolved

Since its creation, Uniswap has known a rather impressive growth. With its protocol that has gradually improved through different versions, each time with technical advances aimed at making exchanges more accessible and efficient.

Uniswap V2, launched in 2020, gave the possibility to create more flexible token pairs and to use tokens as reference assets instead of only ETH.

In 2021, with Uniswap V3, the protocol went through a new major step with the integration of liquidity concentration. This means that liquidity providers can themselves choose the price range in which they want their capital to be used, which improves capital efficiency and increases returns.

These different innovations allowed Uniswap to establish itself as one of the biggest decentralized exchanges in the world, as it has daily trading volumes often higher than several billions of dollars.

This protocol has been deployed on different blockchains compatible with Ethereum, which helps to reduce the high transaction fees on the main network. This allowed Uniswap to reach a wider public and therefore increase its accessibility.

Source : cryptoast

The UNI token and its usefulness

The UNI token is the original token of the Uniswap protocol. It was launched in September 2020, and it is designed to give the community governance power over the future of the protocol.

All people who hold a UNI token have the possibility to propose changes or to vote for important decisions, but also to participate in the management of the protocol’s resources.

Initially, the distribution of the UNI token was done in the form of airdrops for the first users of the protocol. This strongly marked the history of decentralized finance. Now, the token is used to support the development of the ecosystem, to fund related projects, and to reward the different users who actively participate in the platform, notably by providing liquidity.

The UNI token is also a listed asset on the majority of major exchange platforms. Its value has seen significant increases, especially during the bull run of 2021, when the token reached a price close to $44.

It continues to play an important role in the Uniswap ecosystem, as it represents both governance, community participation and the future of the protocol.

Source : crypto logo

What to know about Uniswap’s future

Like many decentralized finance projects, Uniswap does not escape the various regulations. Its fully decentralized nature makes its legal framing more difficult, but some countries like the United States are more and more interested in decentralized finance platforms and governance tokens. For the moment, Uniswap has avoided regulatory conflicts, but the evolution of the legal framework around cryptocurrencies could influence its development in the coming years.

Another debate that is quite frequent concerns the real level of decentralization. Although Uniswap is designed as an open protocol managed by the community, some criticisms think that the initial developers and large token holders still have a strong influence on decisions.

To this day, Uniswap is considered as a main actor in decentralized finance. Its technology, its vision, and its massive adoption make it one of the most influential platforms of Web3. Its protocol being in constant evolution, its future is linked to the evolution of decentralized finance, but also to the innovation of blockchain technology and the different regulations that may be put in place in the future.